Disability Income

Disability coverage provides you with income replacement in the event you are unable to work due to an accident or illness. When making your disability benefit election, it is recommended that you consider the amount of sick leave you have saved in addition to how long you could wait for the benefit to start. Sick Leave must be exhausted before the disability benefit begins. The district’s disability plan is administered by The Hartford.

Plan Highlights

Monthly Benefit Amount: Select from $200 to $10,000, cannot exceed 66.67% of monthly earnings.

After 12 months, your disability benefit will be reduced by other sources of income, such as sick l

eave, workers compensation, retirement benefits (including Social Security, Teachers Retirement/Public School Employee Retirement)

You elect a waiting period in line with your available leave balance and/or the amount of time you can wait for your disability income to start. Choose from a 14 day, 30 day, 60 day, 90 day, or 180 day waiting period.

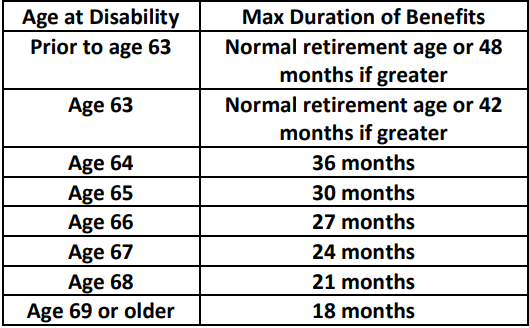

The benefit duration is based on your age when a disability occurs. See table below:

Federal Income Taxation: Since 100% of the disability premiums are paid with “after-tax” dollars,

any benefits received would not be taxed.

Definition of Disability:

You must be under the care of a physician.

Cannot perform the material and substantial duties of your regular occupation.

After benefits are paid for 24 months you must be unable to perform all the material duties of any occupation you are fitted by education, training and experience.

Pre-existing condition limitation: Applies to conditions in which medical services were received

within 3 months of the effective date of coverage. No benefits are payable for such condition

until covered for 12 consecutive months. Applies to new enrollees as well as enrollees increasing

benefits