Aflac

The district offers additional supplemental plans administered through AFLAC. Our AFLAC representative can assist you with enrollment and/or making changes.

Whole Life Insurance Option:

·You may elect to cover yourself, your spouse, and children

Premiums remain level for the life of the policy and build cash value. They do not change as you get older. When you retire or terminate employment you simply pay the same premium rate direct to the insurance company rather than through payroll deductions

Policy is portable

The cost of the plan is based on your age, tobacco status and amount of coverage you choose. Coverage must be approved by insurance company. See AFLAC Representative for rates.

Accident Coverage:

Pays benefits for the treatment of injuries suffered as the result of a covered accident

Coverage for fractures, burns, concussions, lacerations, etc. due to an accident

Benefits are paid regardless of any other insurance you may have

24 hour (on and off the job) coverage

No limit on the number of claims

Benefits for both inpatient and outpatient treatment of covered accidents

Benefits are available for Spouse and Dependent Children

No health questions asked in order to participate

Coverage is Portable

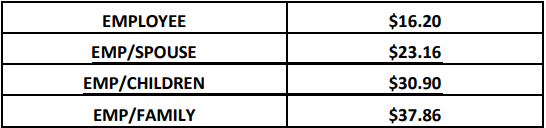

Monthly Premiums:

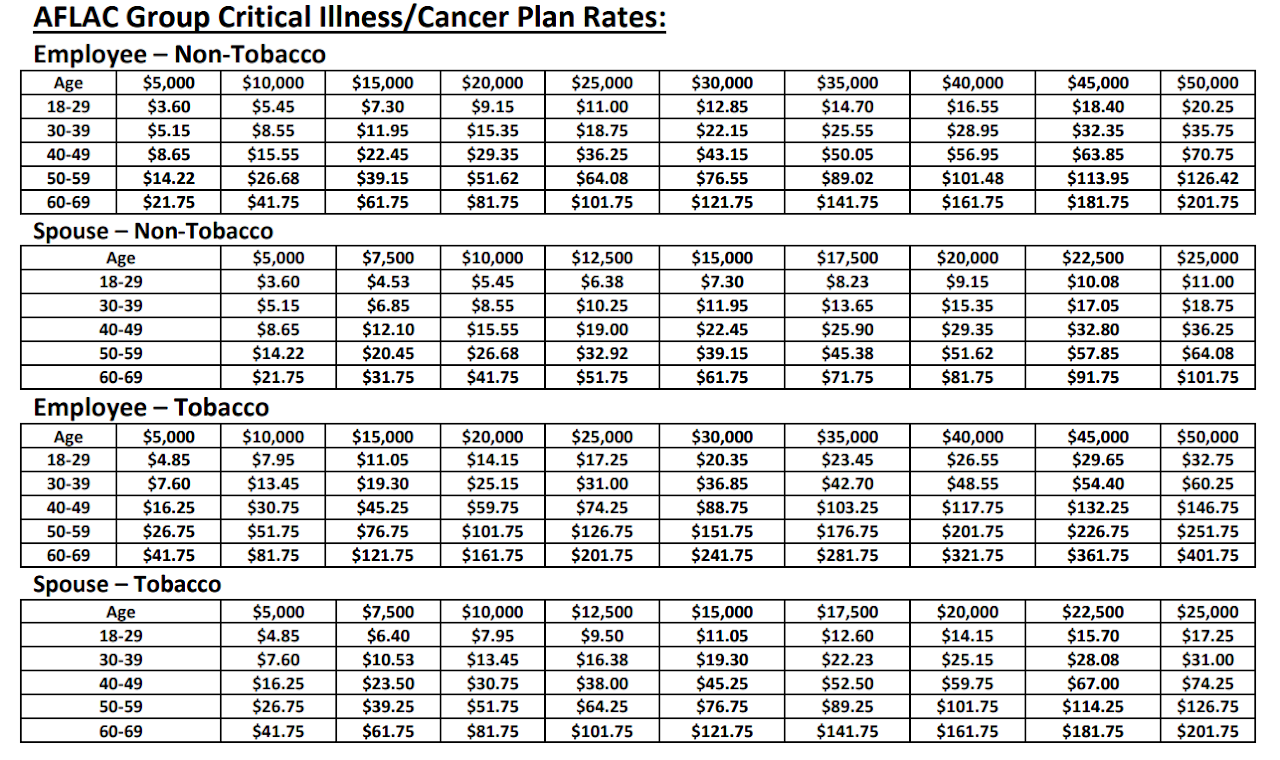

Critical Illness

AFLAC’s critical illness coverage is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness. Policy pays in addition to any other insurance you may have. Rates do not increase as you get older.

Benefit Choice: From $5,000 to $50,000 for employees and $5,000 to $25,000 for spouse

No premium charge for dependent children under the age of 26

Covered illnesses: Cancer, Heart Attack, Stroke, Renal Failure, Major Organ Transplant

Plan includes an annual $50 Health Screening Benefit

For any additional questions or enrollment help, contact our AFLACE representative Ashley Sitz at 478-952-2294