Life Insurance

In order to provide you and your family with financial protection in the event of your death, Peach County School District provides each benefits eligible employee with a basic life insurance plan and accident death and dismemberment insurance through Anthem Life. You may elect additional life insurance for yourself and your dependents through payroll deduction to supplement the Board provided plan.

Proof of good health is required to add or increase your additional life insurance during Open Enrollment.

Employees must enroll in supplemental life coverage on themselves in order to provide coverage for a spouse or dependent child.

Voluntary Life Coverage Options:

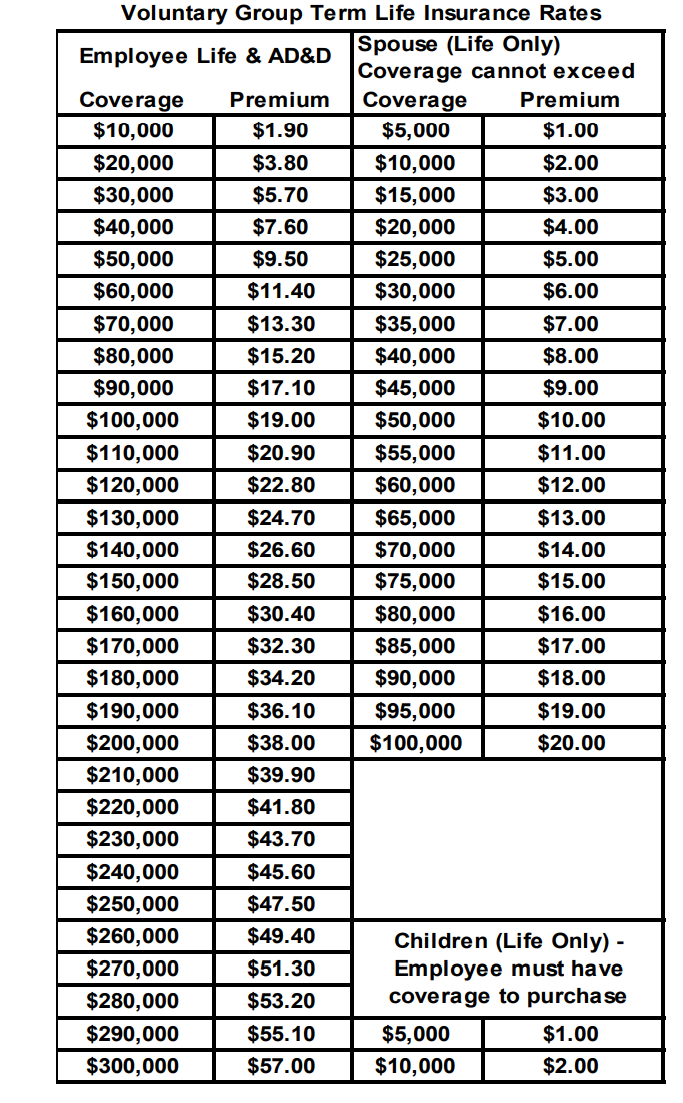

Employee: $10,000 up to a maximum of $300,000, in increments of $10,000

Spouse: $10,000 up to a maximum of $100,000, not to exceed 50% of the employee’s benefit amount

Dependent Children (15 days to age 26): Two benefit options - $5,000 or $10,000, cannot exceed 50% of the employee’s benefit amount.

Common law spouses and domestic partners are not eligible for spouse life coverage.

Child(ren) can be covered only until age 26

You cannot be covered as an employee and as a dependent of another employee. If both you and your spouse are eligible as employees of the school system, both must be covered as employees and only one may enroll for coverage on dependent children.

Benefits reduce to:

65% at age 65

55% at age 70

25% at age 75.

*All benefits terminate at retirement. Coverage can be ported at termination of employment or retirement.

Beneficiaries

You will be required to provide your beneficiary information at the time of your enrollment. A beneficiary is a person who would receive your life insurance benefit in the event of your death.

Evidence of Insurability (EOI)

As a new hire, you may elect up to the lesser of 3 times your earnings or $300,000 for yourself and up to $25,000 for your spouse with no health questions. Should you wish to elect an amount that exceeds the Guarantee Issue, an Evidence of Insurability Form is required. You may obtain an EOI Form from the Resources. Most new and additional elections at Annual Open Enrollment also require an Evidence of Insurability (EOI). To apply, simply complete the form and submit it to Anthem Life for review. You will not be deducted for your pending amount unless / until you are approved.

Portability and Conversion

You have the opportunity to continue your life insurance benefit should you leave employment for reasons other than retirement or disability, this feature allows you to take your optional life insurance coverage with you by paying the required premiums. You must have been insured by Anthem for at least 12 months and must be under age 65. You must apply for coverage and pay the first month’s premium for the policy within 31 days. Ported rates are based on age and tobacco usage and will be billed quarterly, semi-annually or annually directly by Anthem Life. Policy terminates at age 70. You may either port your policy to an individual term life plan or convert your policy to a whole life plan upon termination. Additional information regarding these two options may be obtained by contacting Anthem Life.