Retirement

Peach County Schools cares about each employee’s financial well-being. The district participates in the Teacher’s Retirement System, Public School Employees Retirement System and AIG supplemental retirement plans.

District employees are required to participate in the Teacher’s Retirement System (TRS) or Public School Employees Retirement System (PSERS) based on the position held. In addition to the state retirement plan, employees are able to save additional funds in the district’s supplemental retirement plan through AIG.

Teachers Retirement System (TRS)

The following personnel are covered under the TRS, a state retirement plan, as a condition of

employment:

Certified Teachers

Administrators

Clerical Staff

Paraprofessionals

Lead Custodians

School Nutrition Manager

Supervisors

Your TRS account is funded by you and Peach County Schools.

Your contribution is 6% per month and as of July 1, 2022, the district’s contribution is 19.98%.

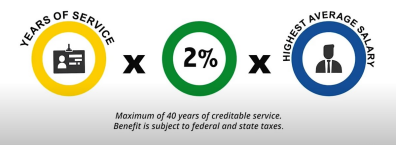

Employees are vested after 10 years of service and able to draw a benefit at age 60, or 30 years of

service regardless of age. Your retirement amount is based on the following formula:

Active TRS members may access their membership statements online via their TRS account. The statements provide valuable account information, such as an account balance, the lump-sum value of an account, as well as beneficiary and service credit information. Click here to visit the TRS homepage for more information.

Public School Employees Retirement System (PSERS)

The following personnel are required to participate in PSERS, a state retirement plan, as a condition of

employment:

Bus Drivers

Bus Monitors

Nutrition Staff

Maintenance

Custodians

The employee contribution for employees hired before July 1, 2012 is $4 per month for 9 months ($36 per year).

The employee contribution for employees hired on July 1, 2012 or later is $10 per month for 9 months

($90 per year). Effective July 1, 2022, your retirement benefit will be $16.00 per month times the number of years of service. An employee age 65, with 20 years of service could receive a benefit of $315 per month depending on the type of payout elected. Employees are vested after 10 years of service.

PSERS statements for active contributing members are available online. Click herefor access and more information.

Supplemental Retirement Plans through AIG

Employees are automatically enrolled in a traditional 457B retirement plan through AIG at 3% of their base compensation. There are additional plans to choose from including Roth options. Supplemental retirement funds enhance the state retirement plans of TRS or PSERS and provide additional funds at the time of retirement. Employees are able to opt out of participating in the supplemental retirement account; however, doing so will lower the amount of retirement income available at the time of retirement. Our AIG representatives can assist in review of your current supplemental retirement elections or to enroll in a plan that best suits your needs.